Ramadan is just one of the four pillars from Islam, which is the spiritual practice of fast of start so you can sundown inside ninth month of the Islamic diary. Numerous degree, including (Białkowski et al. (2012), Al-Hajieh et al. (2011) and you can Al-Khazali (2014), have discovered stocks inside Muslim regions to give high output while in the Ramadan compared to other countries in the year. Its overall performance had been explained because of the proven fact that Ramadan encourages Muslims optimism which includes an optimistic affect inventory rates. Some other challenge inside Islamic financial could have been exploitation of worst gullible people in title of faith. The brand new Institute out of Chartered Accounting firms of Pakistan points Islamic Economic Accounting Criteria (IFAS). At the time of 2015, $2.004 trillion inside property were becoming treated inside the an excellent Sharia-compliant fashion with regards to the State of your own Global Islamic Discount Declaration.

Exactly what are a few of the dangers of name deposits?

The high quality limitation deposit here is their site insurance rates amount is actually $250,000 for every depositor, per insured bank, for each and every membership possession category. Your own Insured Places is a comprehensive breakdown away from FDIC put insurance publicity for well-known account ownership categories. Landlords within the claims rather than shelter deposit desire commission laws and regulations don’t have any demands to expend attention for the money accumulated at the start.

Chase Complete Examining, Chase Deals℠

Consequently if you have deposits in numerous membership classes at the same FDIC-covered bank, their insurance policies can be more than $250,100000, in the event the the conditions try satisfied. It’s also wise to get to know our very own Discounts & Video game Calculator to help you understand the importance of compounding focus during the high rates in your deals throughout the years. BestCashCow’s studies demonstrate that on the internet financial institutions provide high savings and Computer game prices as they has all the way down costs out of without having to keep up brick-and-mortar towns. Hence, we highly recommend that most depositors take into account the prices at the on line banking companies because the savings and money field accounts on line can also be easy end up being set up to allow quick transmits for the favourite local bank. If you are these types of costs will most likely not are available extremely high, OCBC features handled seemingly low fixed deposit prices for the past several months anyway.

- It brochure will bring first details about the sorts of accounts you to definitely are covered, visibility limits, as well as how the newest FDIC makes sure your bank account should your lender fails.

- On the majority of all of us that typical banking consumers, the highest fixed put speed you can purchase with HSBC which month is just step 1.20% p.a good.

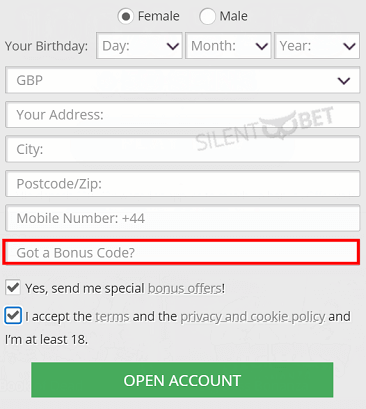

- You’ll find plenty of bonuses here and you are going to be used to raise a new player’s financial move.

- Customers just who discover at the least $500 within the monthly direct deposits can enjoy Newest’s Overdraft solution, and therefore spots around $two hundred in the overdrafts with no commission.

Country-Specific Financial

No deposit gambling enterprises are some typically the most popular as much as as they provide people totally free casino cash that they’ll use to sample away their games. When these special promotions were first brought 2 yrs right back, they quickly become the most famous options and so they turned-out in order to be an excellent way of getting the new players to join up to have a merchant account. After detailed dealings to your greatest websites available to choose from, we caused it to be private coupons for you personally. This type of no deposit (nd or ndb) requirements can only be discovered right here, so make sure you below are a few our very own listing for the a consistent basis.

Banking Provides

Unlock another Upgrade Benefits Checking Along with account and you can money it with any amount. Install lead deposits with a minimum of $step 1,100000 each month, within the basic 60 days, first off earning 2% money back. It Monetary Remarks will bring a track record of mutual dumps and you will teaches you how alterations in brokered deposit laws and regulations produced them more inviting in order to banking institutions and you will, subsequently, how mutual places help the effective put insurance rates limit. Its improved explore in the financial disorder away from 2023 implies that that it innovation is going to be utilized whenever the demand for covered places expands.

Concurrently, specific banks and you will identity deposit organization could possibly get demand monetary punishment when the you opt to withdraw money from the word deposit until the full term finishes. These types of punishment might take the form of a damage payment otherwise an excellent forfeiture out of a share or all desire your may have gained on the transferred number. For these looking to a professional way of spending their money, a phrase deposit could possibly offer the opportunity to deposit financing having the picked bank while you are protecting a predetermined interest rate. That it arrangement makes you take pleasure in consistent output out of your wide range over a predetermined several months.

The newest Benefits Family savings produces 1 percent cash back to the sales, and it also brings very early access to head placed paychecks. I pay type of focus on if head put or specific transactions are expected, and how a lot of time deposits must be kept inside the a keen account and exactly how long it takes users for their bonuses when they fulfill the criteria. We as well as gauge the membership’ long-label really worth just after bonuses is actually gained, factoring in every interest or month-to-month fees.